Project Description

The TaxAide project aims to enhance government digital solutions, specifically designed to support vulnerable and at-risk groups in meeting their tax obligations.

By simplifying access to the tax and superannuation systems, TaxAide ensures that these individuals can more easily comply with requirements and access their entitled benefits.

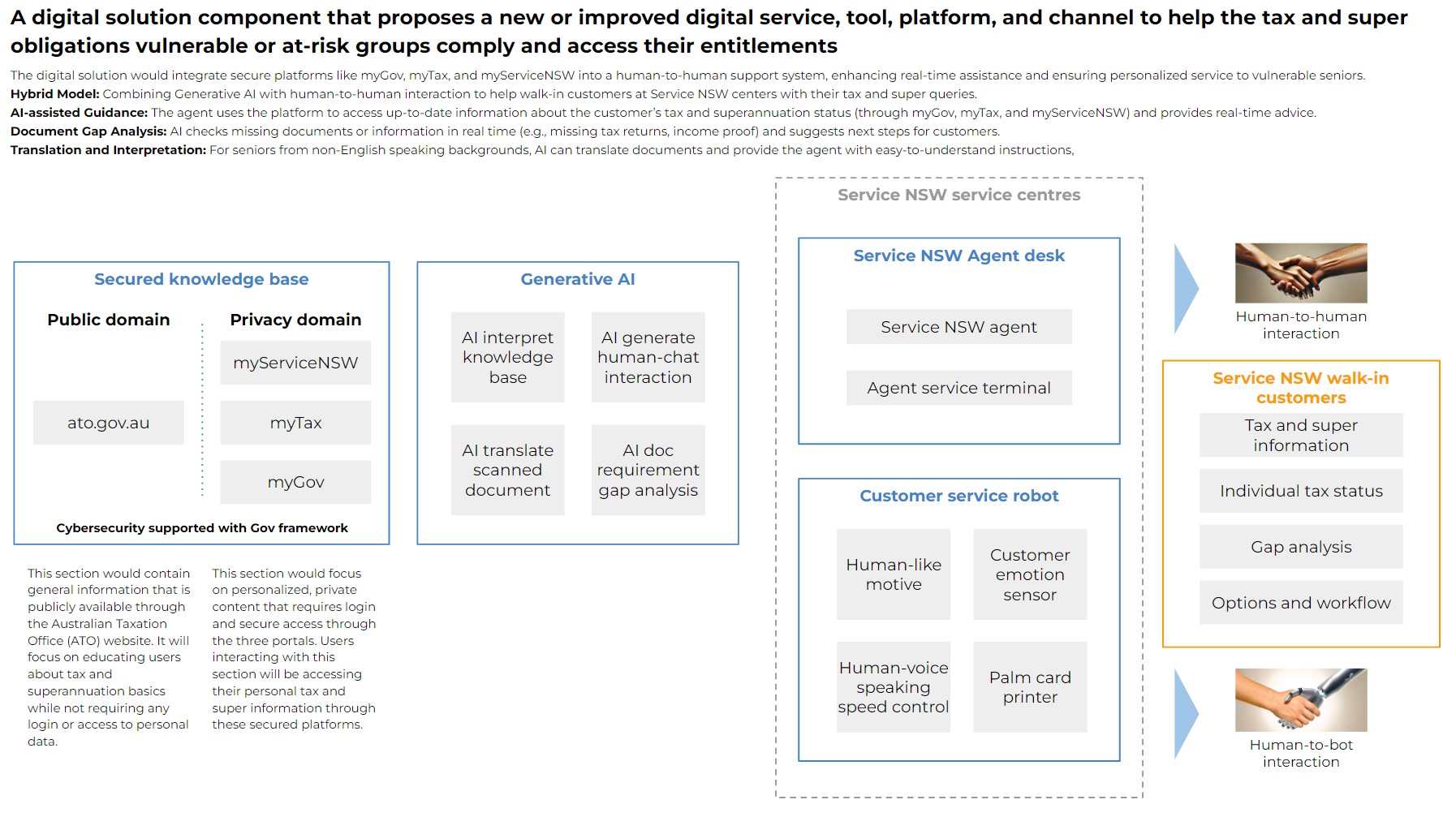

TaxAide is a new AI-powered digital platform designed to assist the Australian public in accessing personal tax and superannuation information.

It integrates seamlessly with Service NSW's existing digital solutions, including myServiceNSW, myGov, and myTax.

The platform’s purpose is to resolve the problem and bridge the gap between internet accessibility challenges (such as skills or equipment) and essential financial information.

By offering an empathy customer-centric approach, TaxAide provides users who face barriers to internet access with an intuitive, accessible way to manage their tax and superannuation details.

Users can online individual tax and superannuation information through human touch conversational interaction.

TaxAide is more than just a standalone technology solution. It represents a blended approach that combines advanced AI with human-centered customer service, optimizing the use of Service NSW and local council facilities, as well as enhancing the skills of public sector employees.

In this era of AI-driven social transformation, TaxAide's human-touch strategy ensures the ethical application of AI while mitigating potential risks.

Additionally, it creates valuable career development opportunities for public sector workers, providing them with upskilling through AI training and a "train-the-trainer" model to empower continuous growth.

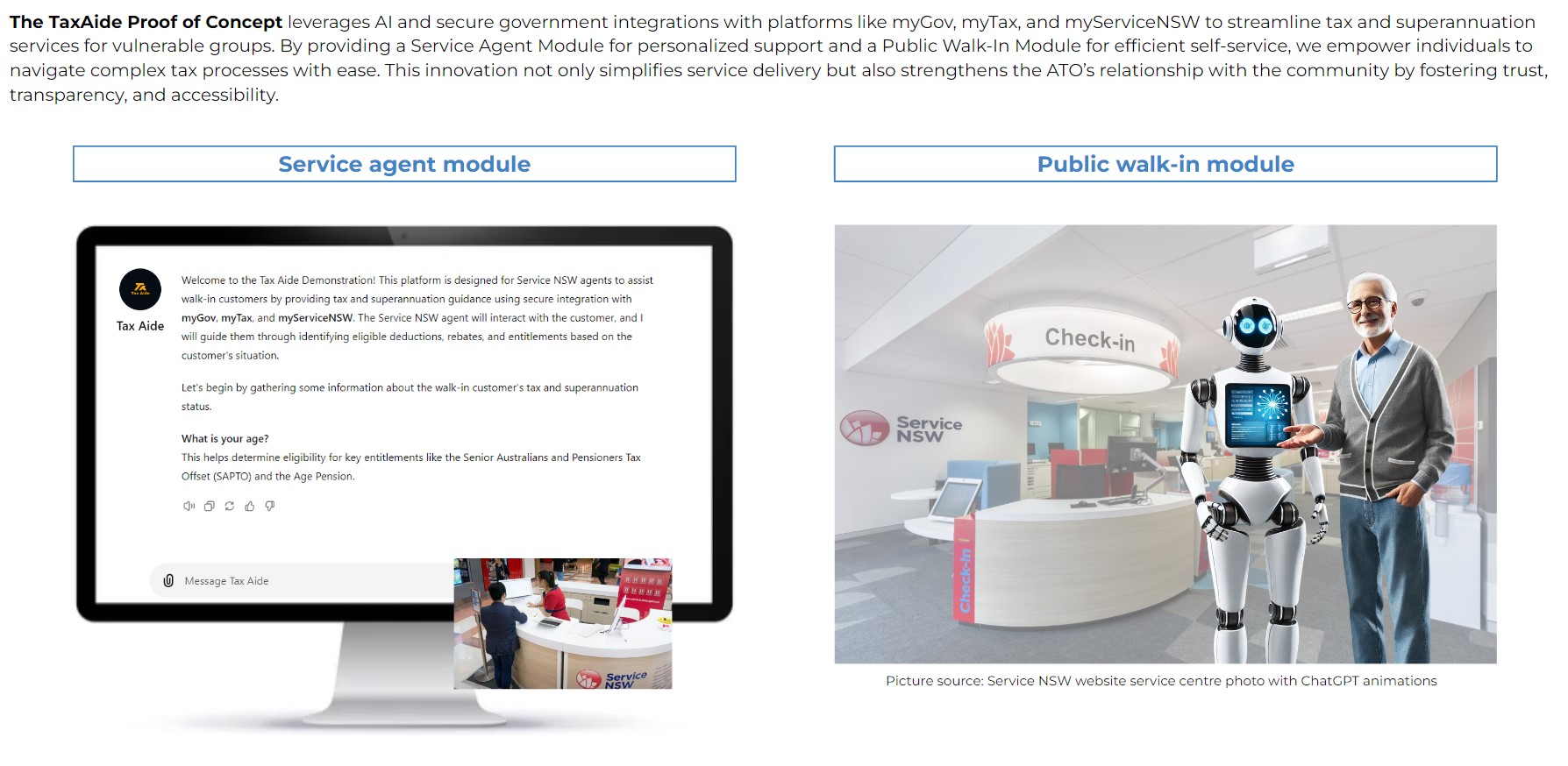

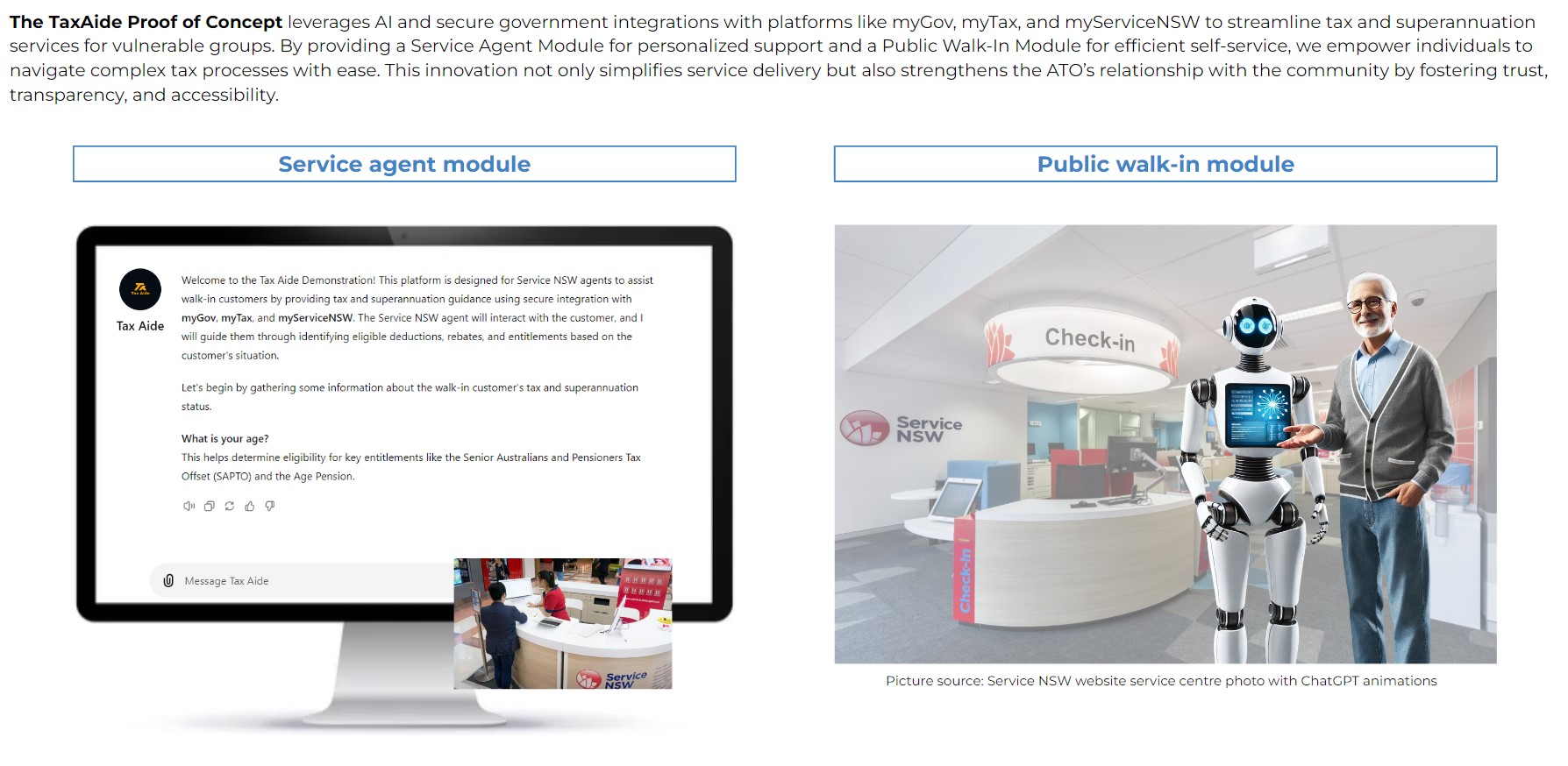

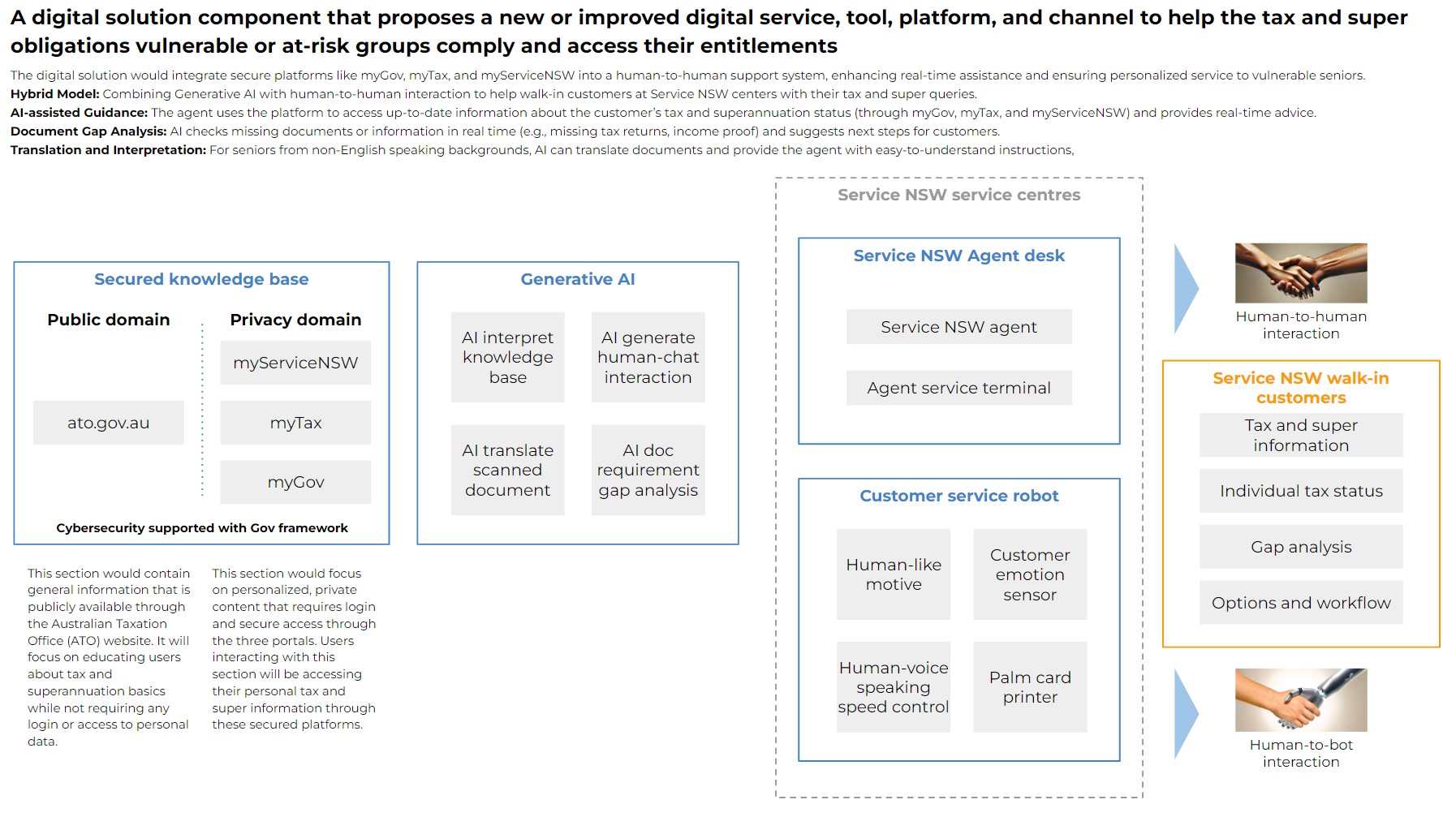

TaxAide can be accessed through two standalone modules, available via two types of service terminals located at all Service NSW service centres:

The service agent module

Integrated with the existing Service NSW intranet, enhances agent support by providing streamlined access to user data. Designed for Service NSW agent to assist walk-in Service NSW customers.

The public walk-in module

An AI-powered customer service robot that mimics human conversation, assists walk-in customers by offering a conversational interface for self-service.

Our design principle is to empower all Australians, especially those in vulnerable groups, by providing seamless, real-human and human-like interactions to access personal tax and super information.

By integrating with Service NSW’s trusted digital solutions, TaxAide ensures a user-friendly, secure, and inclusive experience, enabling individuals to manage their financial details confidently and independently, regardless of technical skills or access to digital equipment.

Data Story

A data analysis component that uses open government data to identify and profile vulnerable or at-risk groups who face challenges or barriers in complying with their tax and super obligations.

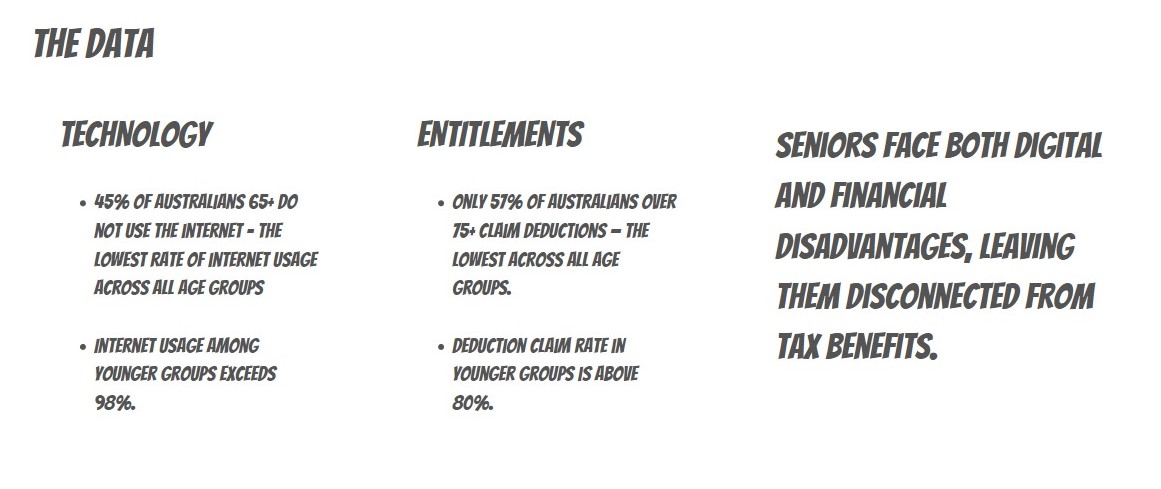

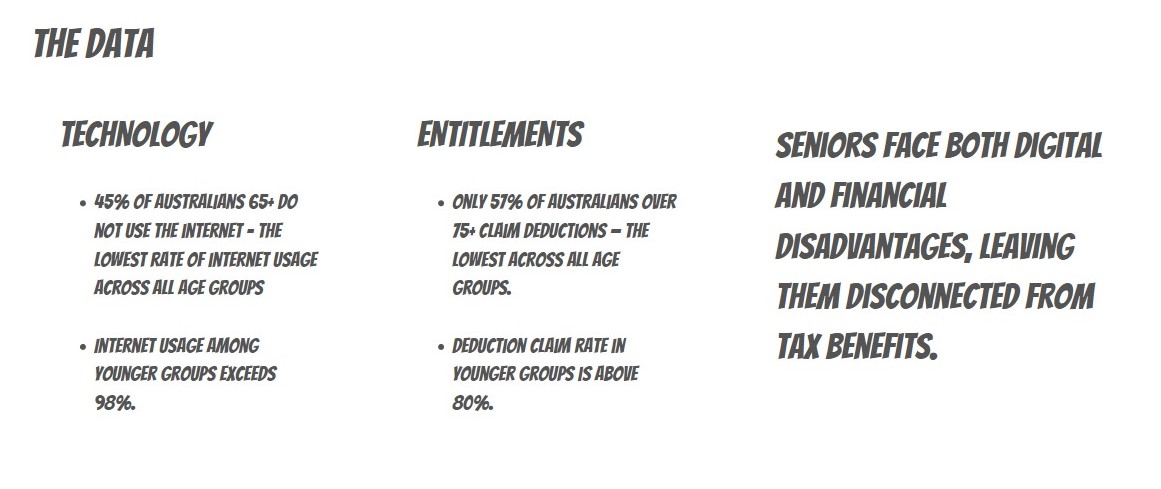

The Digital Divide and Missed Opportunities for Seniors

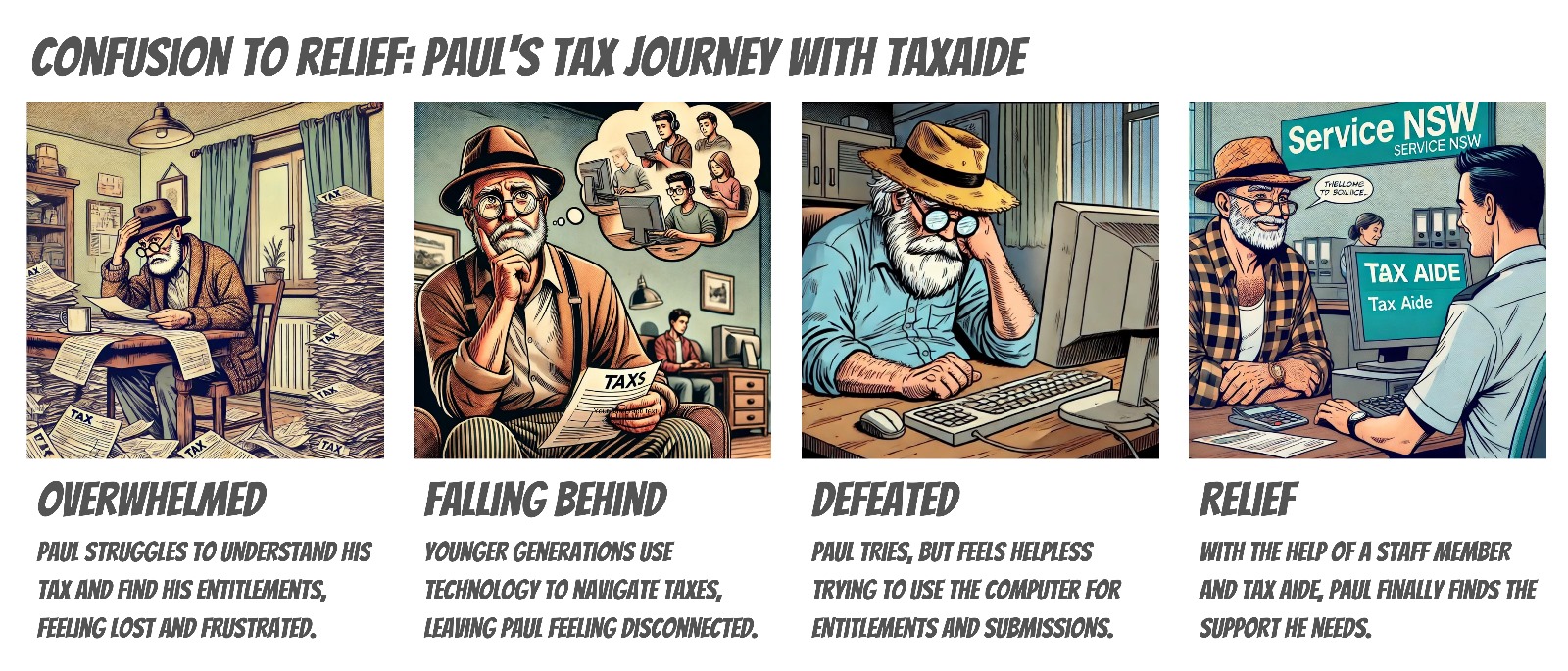

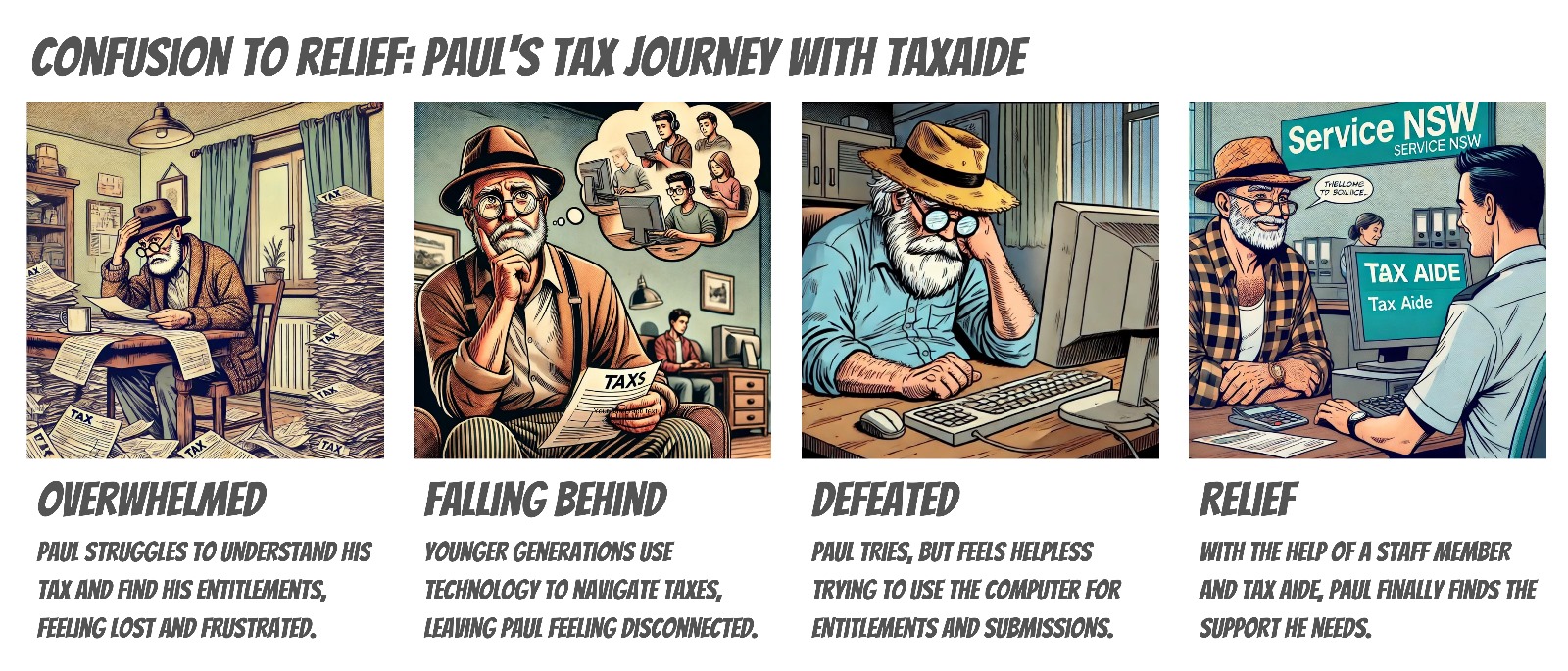

For Australians aged 65 and older, navigating the tax system presents a unique challenge.

As we age, the data tells a compelling story: the likelihood of claiming deductions decreases significantly in this age group, dropping to 57% for those aged 75 and over—substantially lower than the 80%+ seen in younger working age groups.

Data source, deductions not claimed: data.gov.au/data/dataset/taxation-statistics

This trend aligns closely with another striking statistic: 45% of individuals aged 65 and over did not use the internet.

In comparison, internet usage is nearly universal among younger age groups, where only 2-4% report not going online. It’s no coincidence that older Australians are not only less likely to use the internet but also less likely to claim tax deductions.

Data source, internet usage: www.abs.gov.au/statistics/industry/technology-and-innovation/household-use-information-technology

The Impact of Low Internet Usage

Tax processes have become increasingly digital, from lodging returns to finding information about deductions.

Younger Australians, who are mostly online, can easily access these resources. They claim deductions at high rates—around 80% across those aged 25-64.

However, as internet usage falls drastically beyond age 65, the ability to navigate the tax system also seems to diminish, resulting in fewer seniors maximizing their deductions.

Seniors Are Being Left Behind

The data reflects a troubling digital divide, where seniors may lack access to the same information, tools, and support that younger generations use to optimize their tax filings.

This divide means that many seniors could be missing out on entitlements and tax refunds, simply because they aren’t connected to the internet or don’t feel confident using online services.

The Need for Human Help

For many seniors, relying on face-to-face help at Service NSW or local councils may be the only way to bridge this gap.

As more tax services move online, it is critical to provide in-person guidance and assistance to older Australians, ensuring they can still access the full benefits they’re entitled to without needing to rely solely on digital tools.

Data analysis conclusion: Supporting Seniors in the Tax System

The data makes a clear case: without better support, seniors—especially those over 65—will continue to be left behind in an increasingly digital tax system.

Providing tailored, in-person tax assistance or simplified digital tools will ensure that this demographic can claim the deductions and benefits they deserve, even without relying heavily on the internet.

The challanges that the vulnerable group is facing

The digital solution PoC

link to PoC https://chatgpt.com/g/g-colFIFAvA-tax-aide